Structural Damage Coverage Calculator

Insurance Coverage Check

Find out if your structural damage is covered by your homeowners insurance policy based on the type of damage, cause, and your policy type.

In 2024, U.S. insurers paid over $12billion for claims that involved cracked foundations, collapsed walls, or roof‑frame failures. That chilling figure shows why every homeowner wonders: does insurance cover structural damage?

When you hear “structural damage,” you might picture a busted beam after a tornado or a foundation that settles after a flood. The answer isn’t always simple - it depends on the type of policy you hold, the cause of the damage, and how the insurer defines “covered peril.” Below, we break down the key concepts, walk you through the claim process, and give practical tips so you’re not left footing the bill.

What Actually Counts as Structural Damage?

Structural damage refers to any harm that compromises a building’s load‑bearing elements - walls, beams, floors, roof trusses, and the foundation. It doesn’t include cosmetic issues like a scratched paint finish or a broken window pane. Typical sources of structural damage include:

- Severe wind or hail that topples a roof truss

- Water infiltration that weakens floor joists

- Ground movement caused by earthquakes or landslides

- Fire that burns through load‑bearing walls

Understanding the cause matters because most policies only pay for damage caused by “covered perils.”

Standard Homeowners Insurance - What It Usually Covers

Most U.S. homeowners carry a homeowners insurance a policy that protects residential properties against a set of named perils. The "dwelling" portion of that policy generally covers structural damage when the loss stems from a covered peril such as fire, windstorm, hail, lightning, or vandalism. In practice, this means:

- If a tree falls on your roof and collapses a truss, the repair cost is reimbursed up to the policy’s dwelling limit.

- Fire that weakens a load‑bearing wall triggers a claim for rebuilding that portion of the structure.

- Water damage from a burst pipe is covered, but only if the pipe broke suddenly, not if it leaked slowly over months (that’s considered neglect).

The policy’s limit is usually an “replacement cost” figure - the amount needed to rebuild the home with similar materials, not the market resale value.

Common Exclusions - When Structural Damage Isn’t Covered

Even a solid homeowners policy leaves gaps. Here are the most frequent exclusions that catch people off guard:

- Flood insurance a separate policy that covers water inundation from natural bodies - Standard policies exclude damage caused by rising water, even if the water seeps into the foundation and cracks walls.

- Earthquake insurance a supplemental coverage that addresses ground‑motion damage - Most policies list seismic activity as an exclusion, requiring a separate endorsement.

- Wear and tear, termites, mold, or rot - these are considered maintenance issues, not sudden perils.

- Negligence, such as failing to repair a known roof leak, can void coverage for any resulting structural collapse.

Before you assume you’re protected, read the “exclusions” and “perils insured against” sections of your policy.

Key Policy Features to Review

Understanding the language in your declaration page saves you headaches later. Pay special attention to:

- Deductible the amount you must pay out‑of‑pocket before the insurer steps in. A high deductible can make a marginal claim uneconomical.

- Replacement cost vs. actual cash value (ACV). Replacement cost pays the full price to rebuild, while ACV subtracts depreciation - the latter can significantly reduce your payout for older homes.

- Policy endorsement an add‑on that expands or modifies coverage. Endorsements for water backup, equipment breakdown, or “building ordinance” can be crucial.

- Coverage limits for the dwelling, personal property, and additional structures (garage, deck). Make sure the dwelling limit matches current reconstruction costs.

If any of these items are unclear, call your agent and ask for a plain‑English explanation.

Step‑by‑Step: Filing a Structural Damage Claim

- Secure the property. Prevent further damage - tarps for a leaking roof, temporary shoring for a sagging beam, and document the steps you take.

- Document everything. Take photos and videos of the damage from multiple angles. Keep receipts for emergency repairs.

- Notify your insurer promptly. Most policies require you to call within 24‑48hours of discovering the loss.

- Complete the claim form. Provide a detailed description, attach your photos, and list any professional estimates you have.

- Schedule an adjuster visit. The insurer will send an adjuster a professional who assesses the damage and estimates the payment. Be present, ask questions, and supply all documentation.

- Obtain repair estimates. Get at least two quotes from licensed contractors. This helps you negotiate the adjuster’s payout.

- Review the settlement offer. Compare the insurer’s estimate to your contractor quotes. If there’s a gap, you can request a re‑evaluation or hire an independent appraisal a third‑party assessment used when policyholders and insurers disagree.

- Complete repairs. Once you accept the settlement, start the work. Keep all receipts, as they may be needed for final verification.

Following these steps reduces the chance of a denied claim or a low payout.

Tips to Strengthen Your Coverage and Claim Outcome

- Update your policy after major home improvements. Adding a new deck or finishing a basement without adjusting coverage can leave you under‑insured.

- Consider a “building ordinance” endorsement if you live in a jurisdiction with strict retrofit requirements after damage.

- Maintain a flood‑risk assessment. If you’re in a 100‑year floodplain, purchase flood insurance through the National Flood Insurance Program (NFIP).

- For earthquake‑prone areas, add a separate earthquake policy - the cost is typically 0.5‑1% of your home’s value per year.

- Keep a home inventory and store it digitally. Photos of your home’s interior, receipts for major purchases, and a list of structural components help substantiate loss.

- Schedule regular inspections of the roof, foundation, and drainage systems. Proactive maintenance can qualify you for lower deductibles or discounts.

Comparison of Common Policy Types

| Policy Type | Covers Structural Damage? | Typical Deductible | Main Exclusions |

|---|---|---|---|

| Standard Homeowners (HO‑3) | Yes - for listed perils (fire, wind, hail, sudden water) | $1,000 - $2,500 | Flood, earthquake, gradual water damage, wear & tear |

| Flood Insurance (NFIP) | Yes - flood‑related water intrusion that compromises foundation or walls | $2,500 - $5,000 (often % of coverage) | Wind, hail, fire, sewer backup (unless added) |

| Earthquake Endorsement | Yes - seismic movement damage to foundation, walls, roof | 5% - 10% of coverage limit | Flood, wind, pre‑existing cracks |

| Personal Umbrella (adds limits) | Depends on underlying policies; doesn’t add new perils | None (umbrella sits atop existing deductibles) | Same exclusions as underlying policies |

Bottom Line: Do You Have Coverage?

Short answer: If the damage comes from a covered peril listed in your standard homeowners policy, you’re likely protected. If it’s flood, earthquake, or a slow‑building issue, you’ll need a separate endorsement or policy.

Take the time now to pull your latest declaration page, verify the dwelling limit, and confirm you have the right endorsements. A quick review can prevent a nasty surprise when disaster strikes.

Frequently Asked Questions

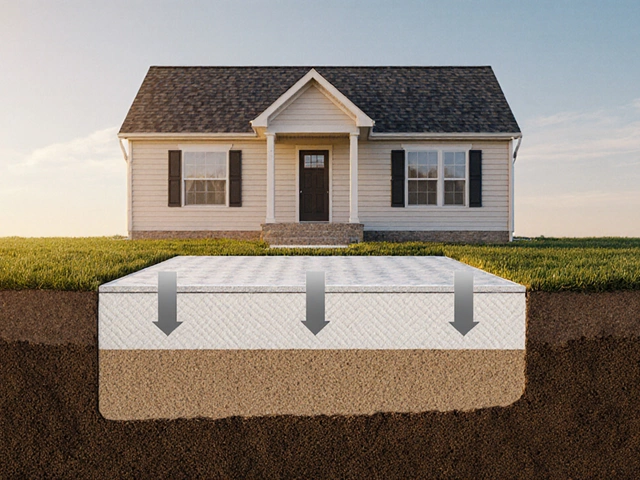

Does a standard homeowners policy cover foundation cracks caused by wet soil?

Only if the soil saturated suddenly due to a covered event like a burst pipe or flash flood. Gradual moisture buildup is treated as maintenance, so you’d need a separate flood endorsement.

Can I add coverage for earthquakes to my existing policy?

Yes. Most insurers offer an earthquake endorsement for a premium that’s roughly 0.5‑1% of your home value. It adds a deductible based on a percentage of the dwelling limit.

What’s the difference between replacement cost and actual cash value?

Replacement cost pays what it would cost to rebuild today with similar materials, while actual cash value subtracts depreciation for age and wear. For structural damage, most policies default to replacement cost if you select that option.

How can I avoid a claim denial for water damage?

Act fast. Document the damage, get a professional plumber’s report, and notify the insurer within 24‑48hours. Show that the water infiltration was sudden, not a result of long‑term neglect.

Do insurance adjusters decide the repair method?

Adjusters provide a cost estimate based on industry standards, but you can submit independent contractor quotes. If there’s disagreement, you can invoke an appraisal clause to get a neutral third‑party assessment.