Foundation Repair Value Estimator

Estimated Value Impact

When a house starts to sink, crack, or wobble, the first thought is often "fix it before it gets worse." But many homeowners wonder whether the repair itself could lower the resale price. The short answer is: a well‑done repair usually protects or even adds value, while a botched job can hurt it. Below you’ll find the factors that swing the balance, practical steps to keep the value intact, and real‑world numbers that show what to expect.

Key Takeaways

- A quality foundation repair typically stabilises the structure and reassures buyers, preventing price drops.

- Disclosure, permits, and documented warranties are critical for preserving value.

- Cost‑recoup depends on repair type, local market, and how the work is presented to appraisers.

- Hiring licensed professionals and keeping thorough records can turn a repair into a selling point.

- Understanding the appraisal process helps you negotiate a fair price after the fix.

What is foundation repair?

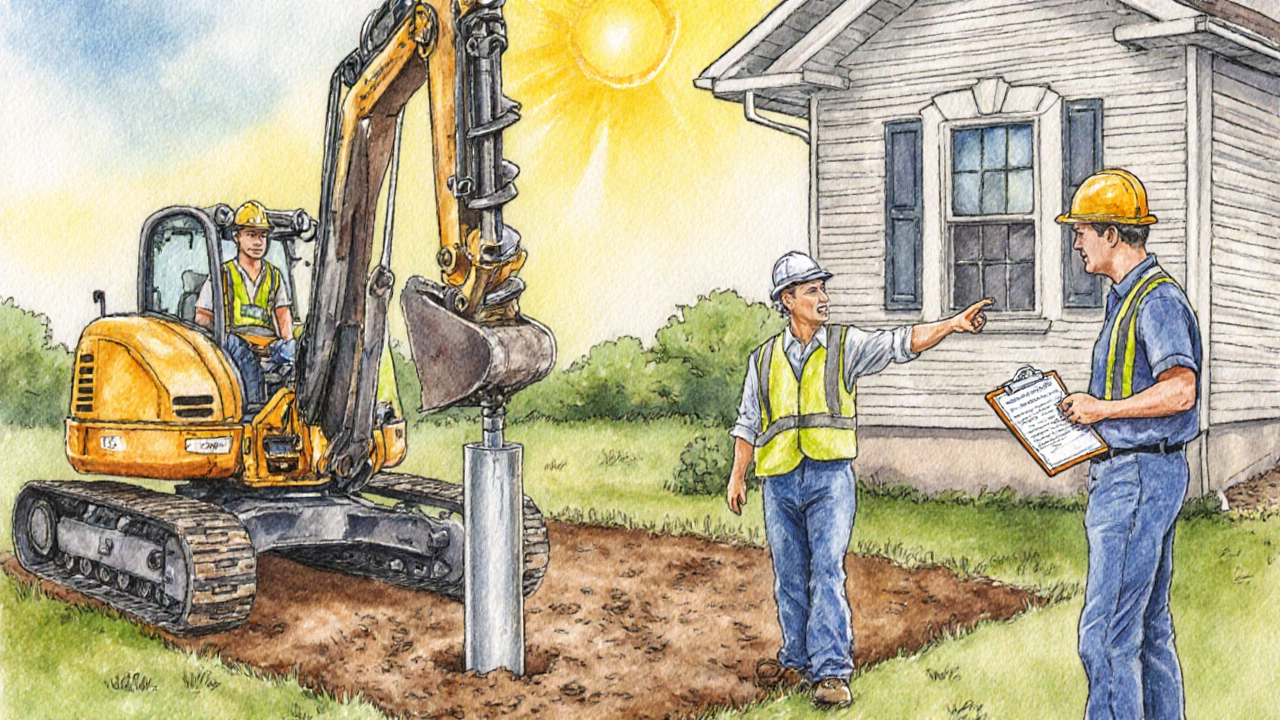

Foundation repair is a set of methods used to correct movement, settlement, or structural deficiencies in a building’s base. Typical techniques include pier installation, slab jacking, wall anchors, and soil stabilization. The goal is to return the house to a level, stable state so that walls stay straight and doors close properly.

Why Homeowners Fear a Value Drop

The anxiety stems from two misconceptions. First, that any repair signals a chronic problem, and second, that buyers will assume the cost has already been baked into the asking price. Both concerns can be managed with the right approach.

How home value is Determined

Appraisers look at four pillars: location, size, condition, and recent upgrades. Real estate appraisal reports assign a value based on comparable sales ("comps") that share similar characteristics. If your house’s condition improves, the appraisal can move up, provided the market supports it.

Factors That Influence Value After Repair

- Quality of Work. Licensed contractors, proper permits, and industry‑standard materials demonstrate durability.

- Documentation. A detailed repair report, engineer’s certification, and warranty paperwork give buyers confidence.

- Type of Repair. Minor pier adjustments usually have a neutral effect, while extensive underpinning can add noticeable value in high‑risk areas.

- Local Market Sensitivity. In regions where foundation issues are common (e.g., clay soils), buyers expect a solid fix and may even pay a premium for a certified repair.

- Disclosure Timing. Being transparent early in negotiations avoids surprises that could derail a deal.

Cost vs. Value: What the Numbers Say

According to a 2023 survey by the National Association of Home Builders, the average homeowner spends $12,500 on foundation repair. In strong markets, the recoup rate averages 70‑85% of the expense, meaning a $12,500 job could raise the appraisal by $8,750-$10,600. In weaker markets, the return may fall to 40‑55%.

Impact by Repair Type

| Repair Type | Typical Cost (USD) | Expected Value Change | Best For |

|---|---|---|---|

| Pier Installation (push or helical) | $8,000-$15,000 | +5‑12% of home price | Localized settlement, moderate soil movement |

| Slab Jacking / Mudjacking | $5,000-$10,000 | Neutral to +3% | Minor unevenness, low‑rise homes |

| Wall Anchors & Bracing | $6,000-$12,000 | +4‑8% | Crawl‑space or basement wall bowing |

| Full Underpinning | $15,000-$30,000 | +8‑15% (high‑risk zones) | Severe settlement, expansive soils |

Step‑by‑Step Guide to Protecting Your Home’s Value

- Hire a structural engineer to assess the problem and recommend the appropriate fix.

- Check local building codes and obtain the necessary building permit. A permit signals that the work meets safety standards.

- Choose a contractor with a solid reputation, proper licensing, and insurance. Ask for references from recent projects.

- After the repair, request an engineer’s certification and a detailed work report. Keep copies in a dedicated folder.

- Store the warranty paperwork (usually 5‑10years) where you keep other home documents.

- When listing the house, attach the repair documentation to the property disclosure. Highlight the certification during showings.

- Provide the report to the mortgage lender or appraiser ahead of the valuation.

- Consider a post‑repair home inspection to confirm that no new issues have arisen.

Common Pitfalls and How to Avoid Them

- Skipping permits. Unpermitted work can lower appraisal value by up to 20% because it raises risk.

- Choosing the lowest‑bid contractor. Cheap labor often means sub‑par materials, leading to future failures and negative buyer perception.

- Failing to disclose. Surprise foundation cracks during buyer’s inspection typically lead to renegotiation or deal fallout.

- Not updating insurance. Some policies increase premiums after a major repair; failing to adjust can cause unexpected costs.

Real‑World Example

Jane in Manchester bought a 1950s semi‑detached home for £210,000. After noticing door frames binding, she hired a structural engineer who recommended helical pier installation costing £9,800. She obtained a permit, completed the work, and received a detailed engineer’s report plus a five‑year warranty. When she listed the house six months later, the appraisal rose to £225,000-a 7% increase that more than covered the repair cost. Buyers cited the documented fix as a confidence booster.

Frequently Asked Questions

Will any foundation repair lower my home’s market price?

Not if the work is done properly, documented, and disclosed. A quality repair stabilises the structure and typically protects the price or adds a modest premium.

Do I have to disclose foundation repairs when selling?

Yes. Most jurisdictions require disclosure of any structural work. Being upfront also prevents renegotiation after the buyer’s inspection.

How much of the repair cost can I expect to recoup?

On average, 70‑85% of the expense in strong markets and 40‑55% in weaker markets. Exact recoup depends on repair type, local demand, and how the work is presented.

Is a warranty necessary?

A warranty is a strong selling point. It reassures buyers that the contractor stands behind the work, and many lenders view warranty coverage favorably during appraisal.

What documents should I keep for future resale?

Engineer’s assessment, permit records, contractor invoices, warranty paperwork, and any post‑repair inspection reports. Store them in a folder labelled “Foundation Repair - 2025”.

Next Steps for Homeowners

If you suspect a foundation issue, start with a visual inspection of cracks, uneven floors, or doors that stick. Then book a qualified structural engineer for a formal assessment. Use the checklist above to guide the repair process, keep every paper trail, and communicate openly with potential buyers. With the right plan, foundation repair won’t just stop a problem-it can become a proven asset when you’re ready to sell.