Picture waking up and stepping onto your bathroom floor only to realize it’s damp and strangely warm. You poke around, and in a panic you discover water’s seeping up from your foundation. A broken pipe under the slab. That sudden dread—is your home at risk, how much will this cost, and will your insurance company even help? Let’s peel back the drywall here and get into everything you need to know about whether homeowners insurance covers those sneaky broken pipes under your foundation.

How Homeowners Insurance Handles Foundation Leaks

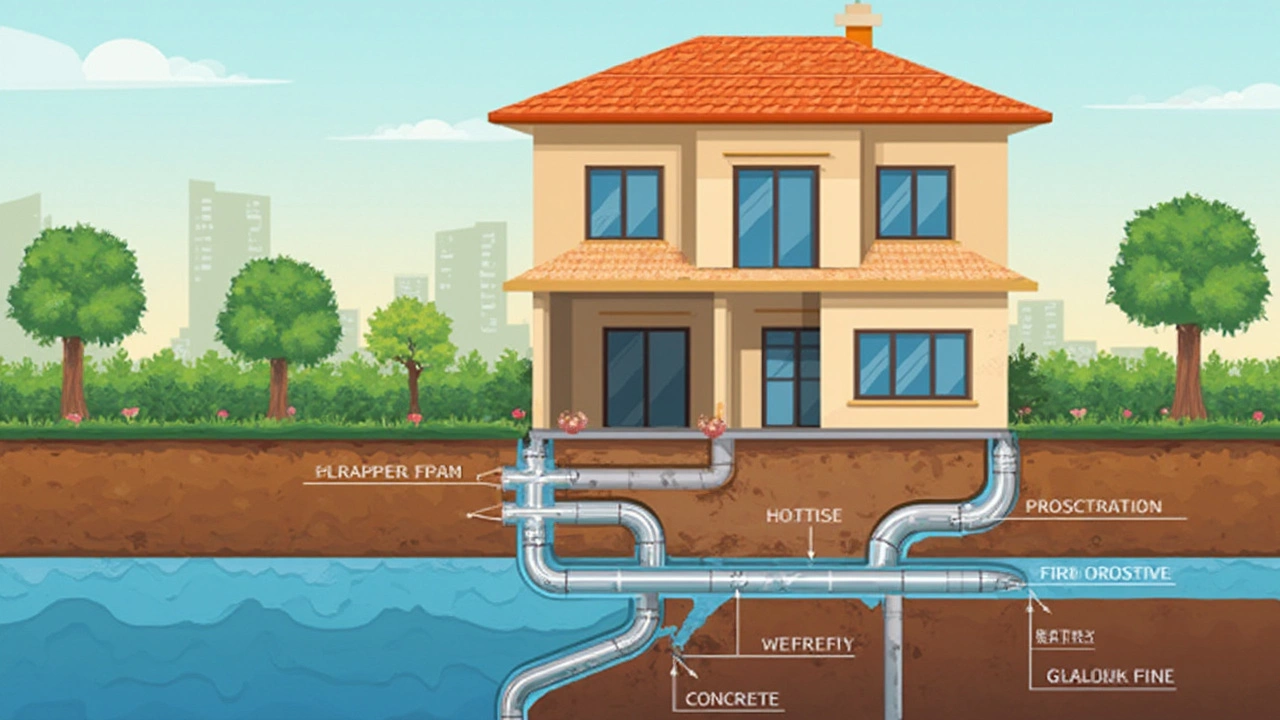

When water starts bubbling up from below, most people’s first thought is, “Can I just call my insurance?” And it’s a great instinct—but insurance coverage for broken pipes under your foundation isn’t as cut and dried as you might hope. Homeowners insurance policies are designed to help with sudden, accidental damage rather than long-term wear and tear. So, if a pipe suddenly bursts because of freezing temperatures, for example, that’s what insurers like to see: an unexpected event, not a slow or preventable one.

Now, here’s the kicker: most standard home insurance policies (like HO-3 or HO-5) technically cover “sudden and accidental discharge of water,” so if a pipe under the slab suddenly breaks and causes immediate water damage in your home, your policy might step up. But wait for it—that doesn’t always mean they’ll cover the cost to access the broken pipe or fix the pipe itself, especially when the pipe sits below your foundation. The actual water damage to your floors, walls, or personal property? Usually covered. The cost to break through the slab to find the leak and repair the plumbing—sometimes not.

Here's a table showing typical coverage scenarios:

| Situation | Covered? | Notes |

|---|---|---|

| Sudden water damage to interior | Yes | As long as it’s accidental and sudden |

| Cost to find/access broken pipe | Sometimes | Depends on your insurer’s policy |

| Repairing the broken pipe itself | No | Seen as maintenance or wear & tear |

| Damage due to long-term leak | No | Gradual leaks often excluded |

This is why people can be shocked when their claim gets partially denied. Maybe you’re getting a new floor, but the thousands it costs to jackhammer through your slab is all on you. Some insurance companies do offer options or add-ons—called “endorsements”—that expand this coverage, so it pays to ask your agent exactly what your policy includes.

What Causes Pipes to Break Under the Foundation?

You might think pipes are pretty safe once they’re buried under inches of thick concrete, but ask any plumber—those lines are still in the danger zone. Pipes underneath a home’s foundation can break for all sorts of reasons. One of the most notorious culprits is soil movement because of expanding and contracting clay, or from freeze-thaw cycles. If the ground shifts, your pipes feel the squeeze—sometimes enough to snap.

Older homes, especially ones built before the 1980s, are at higher risk. Cast-iron or galvanized steel pipes are known to corrode faster, and sometimes clay or orangeburg pipes (yep, some were actually made out of pressed tar paper) just give out over the years. Tree roots are another surprise invader; they’re relentless in the hunt for water, and they can worm their way right into a joint, splitting a pipe over time.

Another silent threat is water chemistry. If you live somewhere with aggressive water—think Santa Fe, or crazy hard water areas—your pipes might be rotting from the inside out. Combine all of this with day-to-day vibration, shifting ground, temperature changes, and even construction nearby, and you see why foundations aren’t always forever. According to the Insurance Information Institute, water damage makes up about 29% of all home insurance claims in the US, so this problem is hardly rare.

Here’s something wild: A 2023 survey from the American Society of Home Inspectors found that nearly 9% of inspected homes showed some evidence of slab leak or foundation pipe issues—usually discovered only after damage had already occurred. The lesson here? Even “invisible” plumbing can betray you, and you probably won’t notice until it’s too late.

How to File a Water Damage Insurance Claim for Broken Pipes

If disaster strikes and water’s bubbling up from below, try not to panic. Quick, smart action is your friend here. Step one is to stop the damage if it’s safe to—turn off the water at the main valve. The quicker you act, the better the odds that your insurance will approve your claim. Insurance companies love it when you limit losses, so snap some photos as soon as possible and document exactly what’s happening: take video of the water, photos of the affected area, and keep records of anything you do in response.

Next, call your insurance agent or claims number—even if you’re not sure whether it’ll be covered. The company will likely send around an adjuster, and they’ll want to see for themselves. Save any receipts you rack up: if you hire a plumber to cut open your foundation or do exploratory work, keep those invoices. If you have to pay for water removal or drying equipment, log every cent you spend. Those receipts are valuable ammunition in your claim.

Remember that insurance is in the business of paying for what’s damaged by the leak, not what actually broke. So they’ll often cover replacing your ruined floors, baseboards, carpets, and sometimes even damaged wiring. But if your plumber says the pipe itself rusted away from years of use, insurance might pass the bill back to you because that’s considered a maintenance issue. This is why plumbers’ reports and photos are so crucial—if your plumber can document that the break was truly sudden and accidental (not neglected), your odds jump up.

- Shut off water supply immediately.

- Take photos and video evidence.

- Call your insurer right away.

- Hire a licensed plumber for an inspection and documented report.

- Keep receipts and a timeline of all events.

Your adjuster might bring in leak detection or restoration professionals. Don’t be shy about asking questions—how much will my policy cover, and what won’t it cover? If you’re not happy with their estimate, you have the right to get your own independent contractor’s bid. Don’t settle if you feel shortchanged.

Tips to Prevent Foundation Leaks and Minimize Damage

No one likes thinking about slab leaks until it’s too late, but prevention can save you tens of thousands of dollars—not to mention endless headaches. Start with regular visual inspections inside your home. Look for unexplained cracking in walls or floors, wet spots that don’t dry, or new hot or cold spots on hard flooring. If you hear running water when all taps are closed, take it seriously.

A smart tip is to invest in a water leak detector. Think of it as a smoke alarm, but for hidden water problems. Basic models cost under $30 and will shriek if they sense moisture where it shouldn’t be. Smart versions that send alerts to your phone and can even shut off your main water? Pricier, but might pay for themselves the first time they save you from a disaster.

Stay on top of plumbing maintenance, especially if you live in an old house or a region with tricky soil. Regularly flush your water heater, because loose sediment in pipes can trigger pressure changes that split lines apart. Professional inspections by plumbers every few years can also help. And don’t let trees get too cozy with your foundation—root barriers can redirect even the most determined root systems.

If your area is prone to freezing winters, wrap exposed pipes with insulation and consider heat tape where appropriate. A slab leak might not freeze, but pipes leading into and out of the slab can split in cold snaps, triggering later breakage below ground level.

- Install water leak detectors or smart sensors.

- Flush water heater once a year.

- Get professional plumbing inspections every few years.

- Maintain proper soil moisture around your foundation (not too wet, not too dry).

- Install root barriers for trees near your home’s slab.

If you discover a minor risk—like slightly less water pressure, or minor leaks—see to it immediately. Insurance rarely pays for gradual leaks, but catching something early keeps it off your home’s "history report" too (future buyers can check this with a CLUE report, so a history of denied claims isn’t a good look).

If you live somewhere notorious for slab leaks—Dallas, Houston, the Los Angeles Basin, and all of Florida come to mind—ask your insurer about a water backup or foundation endorsement. For around $100-$300 a year extra, these add-ons can be a lifesaver if disaster strikes.

What To Do If Insurance Won’t Cover Your Broken Pipe Under the Foundation

No one wants their claim denied, but sometimes the news isn’t great. If your insurance company says no, don’t take it lying down. Get a clear, written explanation of why they denied coverage. Maybe it’s because the pipe broke from old age, or there’s evidence the leak’s been there for months. Sometimes, a second plumbing report can challenge the insurer’s reason—was the break truly sudden? Did it result from a covered event, like shifting soil from a storm?

You can also appeal the claim decision. Ask for a supervisor or a claims appeals department—insurers have internal processes for this, and you’d be surprised how often appeals are successful after you push back with more evidence. If that fails, consider a public adjuster—for a fee (often a percentage of what they win you), they can fight your corner and sometimes get a better outcome.

Don’t forget about state insurance departments. Many have hotlines for frustrated policyholders and can guide you through your rights. Sometimes a call from a regulator gets things moving fast. And if all else fails, check out nonprofits that offer help for home repairs after disasters—especially if your area’s been affected by flooding or earthquakes, special programs could be available.

If you’re stuck paying for repairs yourself, get several bids from plumbers who specialize in slab leak repair. A good company can sometimes reroute pipes through walls or the attic, avoiding breaking up your whole slab (and saving you a fortune). Ask for detailed, written estimates that separate the cost to fix the leak from the cost to restore your home afterward. And always read online reviews—foundation work is not the place to cut corners or hire a guy from Craigslist with a sledgehammer.

If you do decide to switch insurance companies after a denied claim, ask your new agent point-blank how their policy handles slab leaks and foundation pipe breaks. Get it in writing. That way, next time you spot a suspicious puddle, you know exactly what help you can expect.